Other Ways to Give

GIVE STOCKS

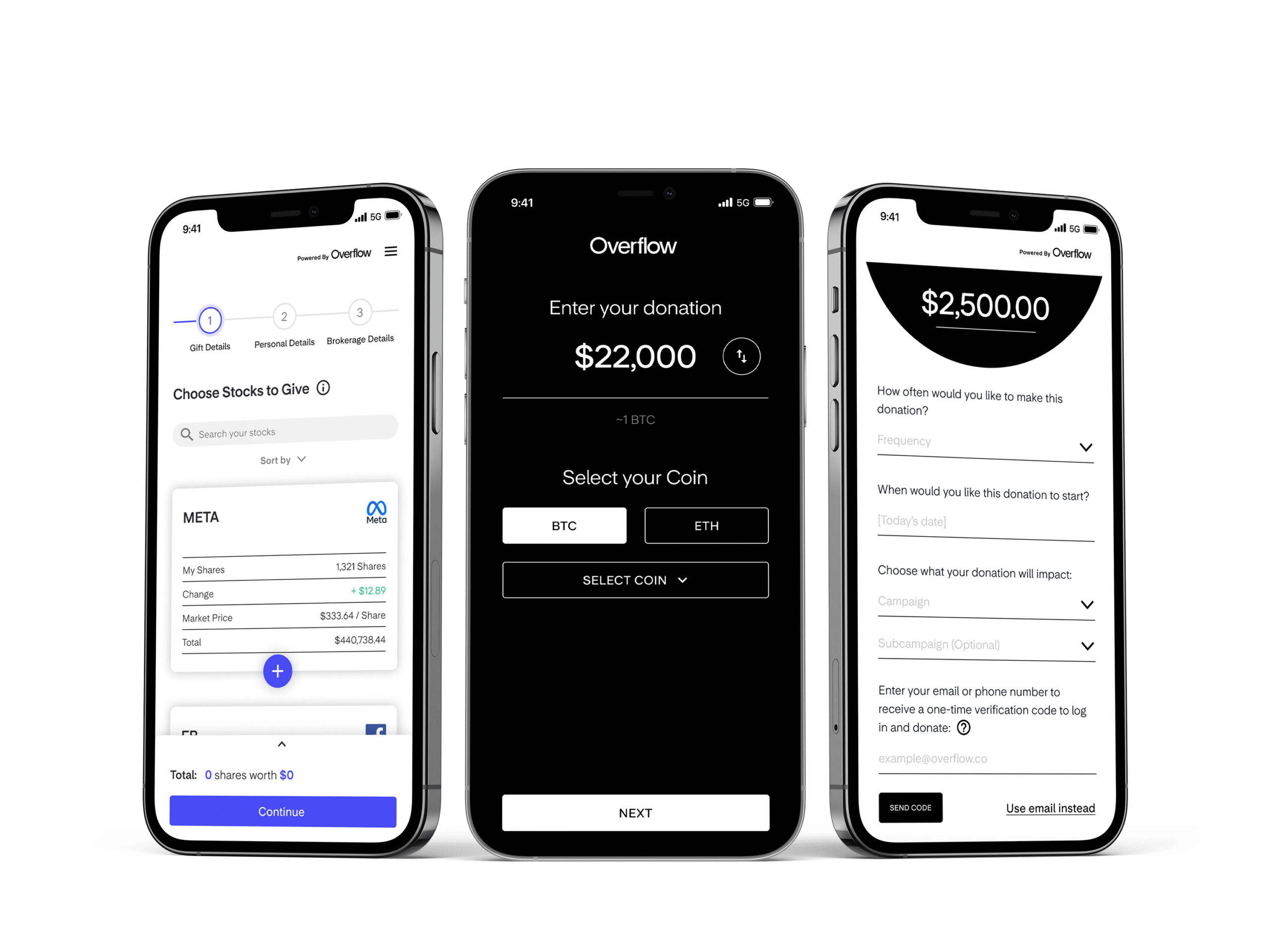

Donating stock can be one of the most tax-efficient ways to give. We’ve partnered with Overflow to make donating stock online quick, easy, and secure.

What is Overflow?

Overflow is a digital solution for donating non-cash assets, enabling donors to give in a tax-efficient way. Donors can experience the ease of giving via stock or crypto in less than five minutes from their mobile devices. Overflow also provides givers access to a private Donor Profile, which enables visibility into transaction history, transaction statuses, and the ability to update connected financial accounts.

What is the tax benefit of donating appreciated stock?

Donating appreciated stock that you’ve held for over a year can allow you to save up to 20% in capital gains taxes and up to 37% in federal income taxes on the charitable donation value of your gift based on your tax bracket when itemizing deductions.

To understand the full tax benefits of giving appreciated stock, including potential state tax savings, please consult with your tax professional for information about your personal tax implications.

What types of shares can I donate?

You can give any publicly traded stock through Overflow. By donating assets that have appreciated in value for more than one year, you are more likely to get the highest tax benefits.

Can I give through my 401K or IRA?

Overflow can process all whole shares of publicly traded stock, including 401Ks and IRAs. However, because donors often incur penalties for withdrawing these assets before a certain date, we highly recommend consulting your tax professional before donating these types of assets. Donating 401Ks or IRA could result in major tax penalties or even fewer tax benefits than donating cash.

GIVE CRYPTO

Donating crypto can be one of the most tax-efficient ways to give. We’ve partnered with Overflow to make donating crypto online quick, easy, and secure.

Is giving through Overflow safe and secure?

Overflow’s Information Security Program follows the criteria set forth by the SOC 2 Framework, a widely respected information security auditing procedure. Overflow does not have access to nor store any brokerage account usernames or passwords. They use Yodlee, a third party provider, that handles the brokerage login process. Over 600 companies including PayPal, Mint, and Amazon use Yodlee to connect their clients’ accounts.

Why should I consider giving through cryptocurrency?

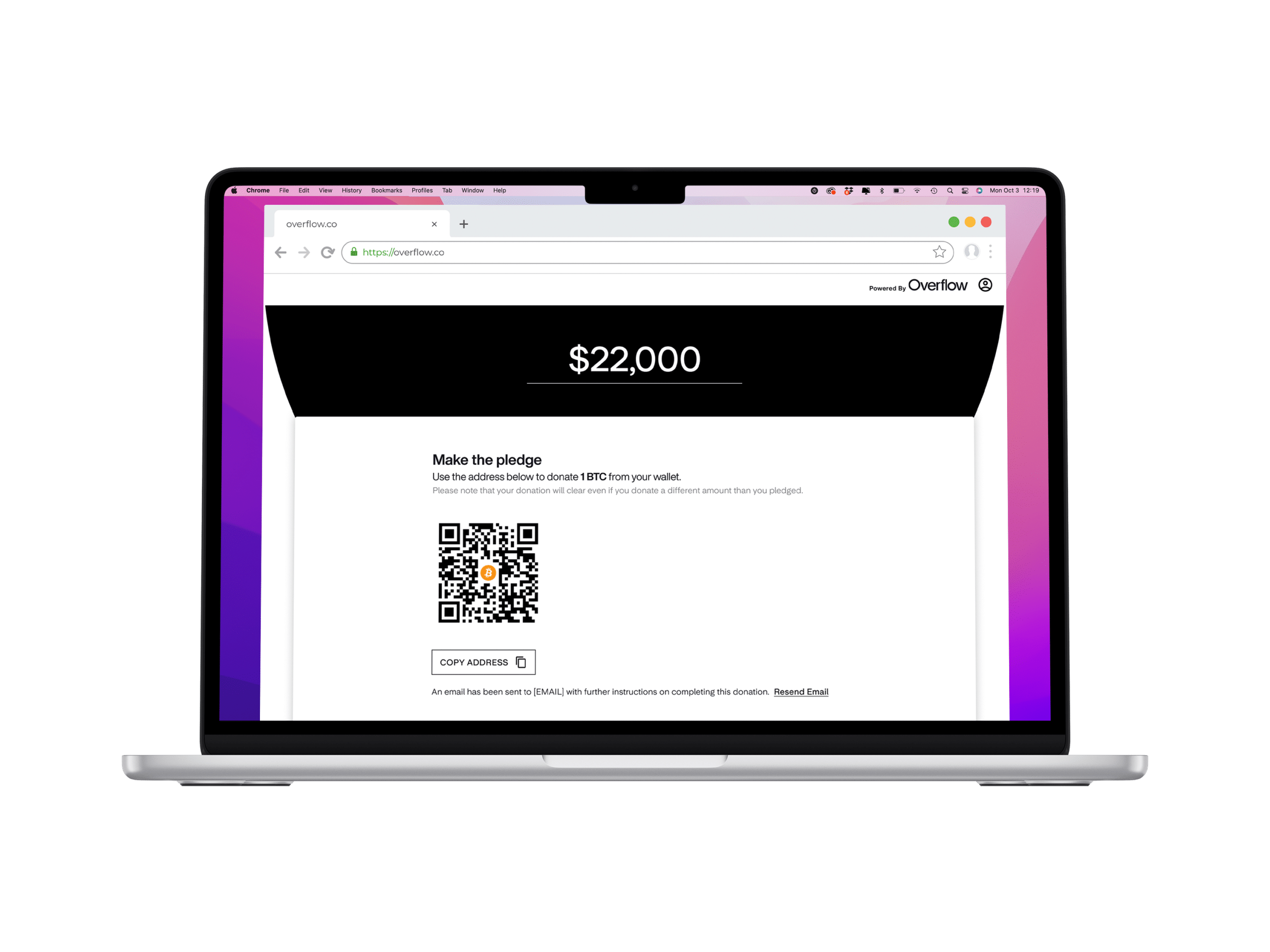

Cryptocurrency can be donated just like other appreciated assets such as stocks. Instead of selling your cryptocurrency and donating the after-tax proceeds, consider donating your cryptocurrency directly to e3 Partners. You will be eligible for a tax deduction equal to the fair market value of the donated cryptocurrency and the appreciation in the value of the donated asset will not be subject to capital gains taxes.

What types of cryptocurrencies can I donate?

Cryptocurrencies that are compliant and accepted within the United States are available to give through Overflow’s crypto donation processing platform. Please refer to The Giving Block website for an up-to-date list of supported cryptocurrencies.

DONOR ADVISED FUNDS

Establishing a Donor Advised Fund (DAF) can help simplify your giving. DAFs allow individuals to make a charitable contribution, receive an immediate tax deduction and then make grants to nonprofits at any time.

Why do people choose to make a DAF?

- Maximized Tax Benefits: DAFs allow for an immediate tax deduction and contributions can be invested and grow tax free.

- Contribute wide range of assets: Particularly advantageous for appreciated assets, DAFs can accept cash, stock, and crypto.

- Flexible options for distribution: Decide when, what, and where to give on an ongoing basis with limited distribution requirements.

- Familial legacy of philanthropy: Can be an easy-to-establish option to allow multiple family members to engage in charitable legacy.

How can you use your DAF to support e3 Partners?

With Overflow, you can now donate from your DAF in a matter of seconds. After finding and logging into your DAF with your corresponding credentials, select the amount you want to give, confirm the amount, and add a note to your gift. It’s that easy!

Qualified Charitable Distribution

What should I consider when giving from a QCD?

Overflow can process all whole shares of publicly traded stock, including from retirement accounts (401K, 403b, Roth IRA, and Traditional IRA). However, donors will incur a tax penalty if they remove retirement funds early (before age 59.5) and some employer-sponsored retirement plans will not allow early fund distribution at all. Because of these restrictions and potential penalties, we highly recommend consulting your tax professional before donating these types of assets. If you decide to proceed, Overflow’s concierge services will work with you directly to facilitate the transfer of these assets.

CONTACT US

If you have any questions about ways to give, we’re happy to help. Please fill out the form below and we will contact you.

e3 Partners Ministry

2001 W Plano Parkway # 2600

Plano, Texas 75075

214-440-1101

Donations by Check

e3 Partners Fund

PO Box 1053

Searcy, AR 72145

Donate

As a non-profit organization, e3 Partners Ministry relies on the generosity of our friends and partners—faithful believers like you who want to see the hope of the Gospel reach every person and place. Your financial gift ensures that our work will carry on until everyone has heard the name of Jesus Christ.

Contact

2001 W Plano Parkway Ste. 2600

Plano, TX 75075

214.440.1101

800.542.2646

Donate

As a non-profit organization, e3 Partners Ministry relies on the generosity of our friends and partners—faithful believers like you who want to see the hope of the Gospel reach every person and place. Your financial gift ensures that our work will carry on until everyone has heard the name of Jesus Christ.

Contact

2001 W Plano Parkway, Ste 2600

Plano, TX 75075

214.440.1101

800.542.2646

ACCREDITATION YOU CAN TRUST

e3 Partners Ministry is highly rated by independent and impartial, third-party accreditation organizations which recognize our longstanding commitment to efficiency, accountability, and transparency.